One of the most common cases our HR and employment law advisers get is around holiday pay and entitlement, particularly how it is calculated. Here are some facts and examples to hopefully clarify some of the myths and confusion around these really emotive employment rights. It is a common understanding that holidays are split between bank and public and flexible leave. For the purpose of the law this is not correct; holidays should be seen as a whole entitlement.

The facts:

- Holiday pay, leave and rights are defined within the Working Time Regulations 1998.

- Under this law, a full time work is entitled to a minimum of 28 days of normal paid leave each full calendar year. This could be seen as:

- 4 weeks, x 7 days, so 28 days; or

- 4 weeks x 5 days, so again 28 days.

- A part time worker, under The Part Time Worker (Prevention of Less Favourable Treatment) Regulations 2000, should not receive less than pro rata the amount a full time worker receives in terms of holiday entitlement.

- An employer, under the Working Time Regulations 1998 can fix certain holidays where the business is closed. This could be for company closures, such as Christmas, Easter, Bank and Public Holidays. Twice as much notice of a fixed holiday must be given in writing when fixing holidays.

- Fixed holidays only affect a worker who would normally work on those days the business is closed.

How does it work?

The following assumes an annual entitlement of 28 days per year, where the holiday year operates from the 1st January to the 31st December.

In 2022 there is an additional day afforded for the Queen’s Platinum Jubilee. Depending on the working in the contract of employment this may need to be legally added. Some contracts do say, for instance ’20 days plus bank and public holidays’. But if the contract expressly states the maximum number of days afforded then the employer can decide to either a) disregard the additional day, b) fix the day as set out above or c) afford a discretionary additional day of leave.

For the purpose of showing some typical scenarios a typical holiday year without additional or changed bank holidays is considered:

- A worker is full time, 5 days per week, entitled to 28 days per year. There will be 8 bank holidays where the business closes. There may also be another company closure for seasonal holidays such as Christmas, say 5 days. Therefore, there are 13 fixed days, leaving 20 flexible days for the worker to take.

- A worker is part time, 5 half days per week. They are also entitled to 28 days per year, but based on their half day pay. There may also be another company closure for seasonal holidays such as Christmas, say 5 days. Therefore, there are 13 fixed days, leaving 20 flexible days for the worker to take.

- A worker is part time, working Monday, Tuesday and Wednesday. They are entitled to 3/5ths of 28 days, which is 16.8 days. There could be up to 7 bank holidays where the business closes affecting the days they work. There may also be another company closure for seasonal holidays such as Christmas, say 3 days. Therefore, their entitlement 6.8 flexible days.

- A worker is part time, working Tuesday, Wednesday and Thursday. They are entitled to 3/5ths of 28 days, which is 16.8 days. Ordinarily there could be only 2 bank holidays (Christmas) where the business closes affecting the days they work. There may also be another company closure for seasonal holidays such as Christmas, say 3 days. Therefore, their entitlement 14.8 flexible days.

- A worker is full time, 5 days per week, entitled to 28 days per year but on a fixed term contract for six months between the 1st February and the 30th They will be entitled to 14 days per year, less any fixed days that the business closes. This could be two days around Easter along with two further bank holidays days in May. This leaves the worker with 10 flexible days holiday during their fixed term contract.

- A worker is on a zero hour contract. For the time they work, 12.07% is additional holiday pay which they will be entitled to take or be paid.

Holiday pay is based on the worker’s normal pay. If this varies, with commission, overtime or bonuses, then the average of their pay over the previous 52 weeks (disregarding any forms of leave such as sickness, maternity, parental leave etc,) must be considered as their holiday pay.

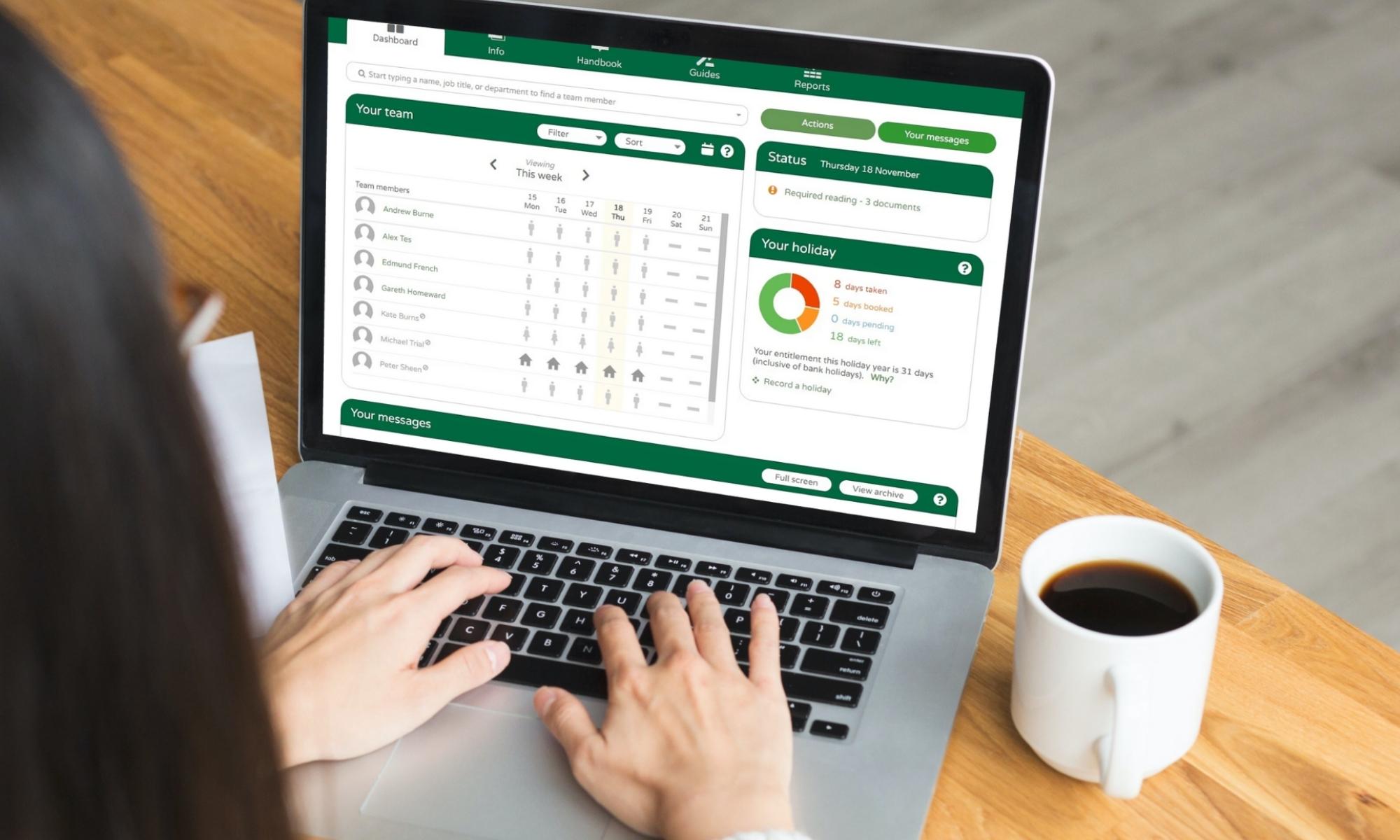

If any of this still seems confusing or time consuming, then think about investing in our HR software.

If any of this still seems confusing or time consuming, then think about investing in our HR software.

Call us on 03456 122 144

Get in Touch